Some short-term scenarios for assessing climate-related risks have just been released by United Nations Environment Programme Finance Initiative (UNEP FI) and National Institute of Economic and Social Research (NIESR), to be downloaded here. See below some ideas of typical use cases to get quickly how to use them.

Some positive comments:

- The tool is practical, easy to get into and use, an Excel-based tool, very visual.

- As well said “climate-related risks are often looked upon as long-term risks”, so this is definitively welcome to be helped to anticipate potential impacts in the short term, i.e the next 5 years here.

- The list of inputs and outputs is quite exhaustive. Shocks are macro, transition, or physical. They can be combined, or studied alone. Granularity is by continent, and for some, possibly by country. Variables include typical s&d data, as well as financial data (fx, ir, infl).

Some less positive coments:

- It would have been appreciated to get more justifications of the shock hypothesis (some based on COVID-19 pandemic or the Russia/Ukraine, some others more adhoc), as well as intensity level (defined in general as +/- 50%). More food for thought on why history exhibits a risk of repeating in a similar manner needed. This is important at the time of concluding something based on a given scenario.

- Having many options to create scenarios, with the possibility to combine them, is good, but too much choice is maybe not that good. In chapt.4, the use of compound risks seems recommanded to create somewhat sufficient severe event (though modelling compound events admitted being at “infancy level”). But for now then, how to define a useful level of severity? It’s not clear.

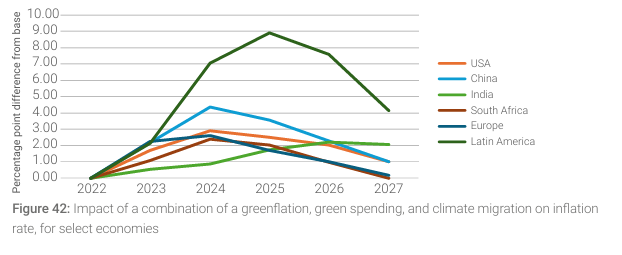

- Data results are available on the 5-years time horizon, from 2022 until 2027. Some historical data earlier in time, like the evolution during COVID-19 pandemic or the Russia/Ukraine conflict would have been much appreciated. Same for an extrapolation after 2027, in dotted line or something to indicate less confidence.

Globally, understanding the reaction of each region/country is valuable, no doubt. See below the impact on the inflation rate for a combination of somewhat ‘climate-friendly’ shocks. Finding global policy agreement is definitely challenging, especially when one region, Latin America in this case, can have such extreme output compared to others.

So I think these are useful elements to generate debates, on regulation, on international trades, etc. at a worldwide scale. However, we must certainly keep things in perspective, it is important to go beyond these data trying to show something of a possible future. Let’s not forget the inherent bias of such modeling, and avoid ending up convincing ourselves better not to do anything. This must not prevent ambitious decisions to face the challenge of climate change, altogether.