Are there many people like me who are concerned about climate change, but also struggle to get a clear picture with numbers on the planet’s capacity to address world hunger, in the short term at least?

Yes, there is chatGPT and its LLM friends, it’s also easy to find a lot of informative blogs written by enthusiasts on specific topics. But I quickly get lost in too much source of info, spending my time cross cheking data

So I was happy to have a look at the OECD-FAO yearly agriculture outlook for the next 10 years, which has just been published. It is one of many reports published by OECD, see here. While 335 pages look intimidating, the advantage is that it is comprehensive, detailed, and easy to navigate in to pick up a desired area of interest. It contains also super informative visualizations!! This will be definitively a reference for any study needing such data. I chose this (sort of) dynamic pdf but I invite the read to have a look at this site https://www.agri-outlook.org/.

I let the reader read by himself the Executive Summary. Very brief summary: The next 10 years will see India/Southeast Asia gaining significant importance as a key player. Agricultural GHG emission intensity expected to decline due to productivity improvements, despite a slight increase in direct emissions (around 5%). Reducing food loss and waste will be essential for significant GHG emission reductions. For global food security, international agricultural commodity markets must continue to function effectively.

Some first remarks:

- Although GHG emission are much discussed, nothing is said about a target warming scenario. Okay, it may not be the scope of this report, sure. But I suppose something on this would have been much appreciated. I suspect the projection align with a sort of business-as-usual scenario despite the GHG emission reduction mentioned, suggesting a warming range of 2.2°C to 3.5°C?!

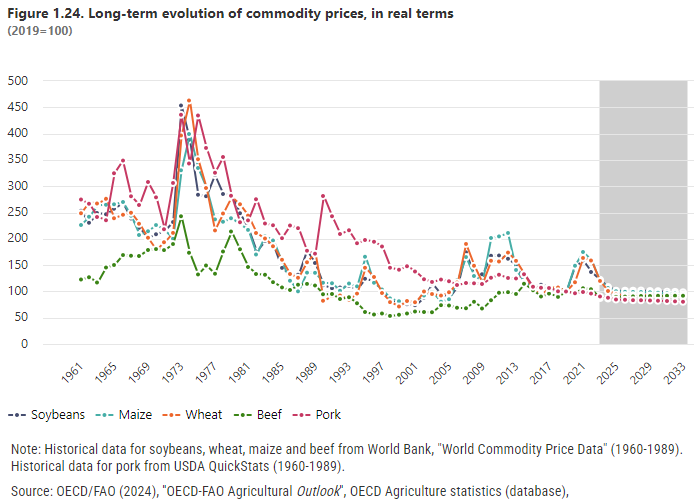

- The long-term evolution of commodity prices says a lot (see below, or this), projecting the next 10 years, along with the past 60 years (in real terms). This forecast suggests that prices will remain at similar level to now. Some stochastic simulations are then shown here, but keep price trajectories limited in a very reasonable range.

So, not too much stress, at least for now? With so recurrent geopolitical tensions and stronger climate event, I feared an occurence of a severe supply disruption, which could generate more volatility and last longer than the start of the Ukrainian war. It seems I was wrong.

- Africa and, paradoxically, Latin America – despite being the largest net exporter – are still facing significant food security challenges. Global agricultural markets are seen as key components for global food security. However, there is relatively little quantitative data (*) about regional trades potential impact, be it on food security, on market volatility, or even GHG emission reduction. Is this undoubtely marginal in the equation?

(*): though not zero! I found something at 2.3.4 for Africa, and 2.7.4 for latin America

some useful extracts to think further:

On food security:

“In the Near East and North Africa region, imports are expected to expand while exports will remain flat, driven by population growth and limited domestic production growth due to resource constraints, contributing to a 32% increase in the net imports by 2033. Net imports of basic food commodities, mainly cereals, into Sub-Saharan Africa are projected to increase by 77% by 2033. Global food and agricultural markets have become more resilient to support the food security needs of its fast-growing population.”

“While the COVID-19 pandemic did affect consumer behavior and agricultural supply chains, China’s robust GDP performance and income support measures in developed countries helped alleviate major food security concerns. Moderate to severe food insecurity increased slightly in 2020 but recovered promptly and has since stabilised well below pre-pandemic levels despite slower income growth.“

“As the biggest net exporter amongst all the regions in the Outlook, it is paradoxical that some of the major challenges facing the Latin America and Caribbean region relate to food security.”

“Improving internal market integration and functioning of small and medium enterprises, cooperatives and family farms could expand trade within the region, thus diversifying market opportunities and bolstering the sector’s resilience.“

“Regionalisation of agricultural value chains for prioritised commodities are part of the African Union strategy to drive agrifood system transformation, increased productivity and agro-processing growth by linking producers and agro-parks in surplus areas to markets and areas of need. The region has placed much hope for expanded intra-regional trade on the successful implementation of the AfCFTA.“

Some nice visualization:

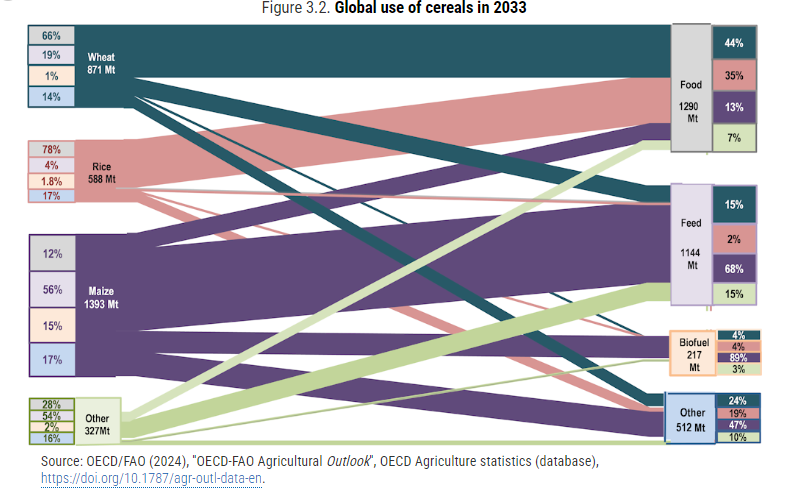

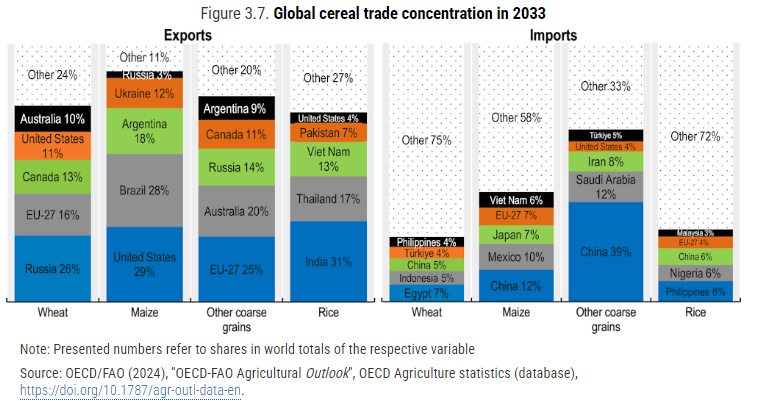

A few visulation to get a quantitative picture of global trade: the long term evolution of commodity price, Global use of cereal, and Trade as a % of production and consommation, or global cereal trade concentration,

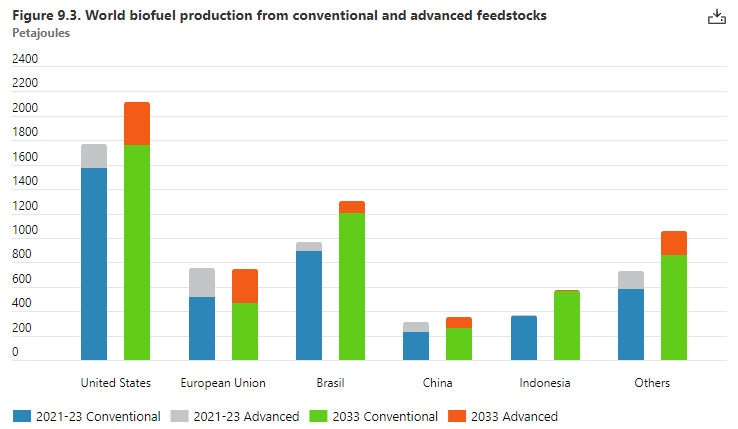

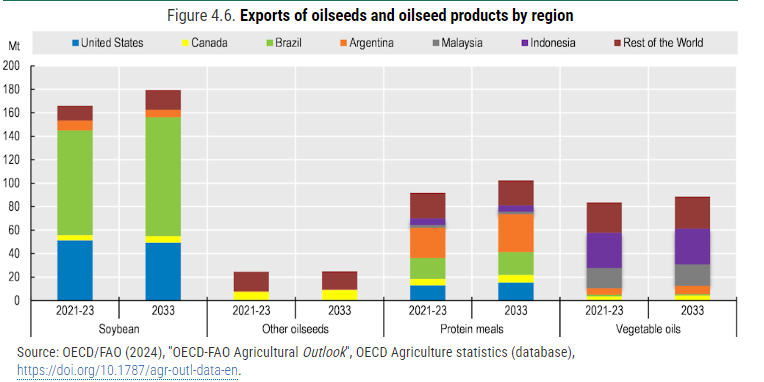

on oilseel, oilseed product use or export oilseed, oilseed crush by region, on biofuel, a few global player, biofuel production from conventional and advanced generation, why so different compared to this from IEA, different def on advanced biodiesel?

Some interesting insight on regulation :

- “The policy environment will be crucial. The reinforcement of food security and the focus on increased sustainability in anticipated reforms (e.g., the Farm to Fork Strategy in the European Union) as well as policies favouring biofuels will heighten competition in the demand for cereals. “

- “China’s domestic policies, which are an increasing influence on import demand as well as domestic production, are also crucial for future developments in cereal markets. “

- ” Export regulations in Argentina are a major uncertainty for the coming years. While the Outlook assumes export taxes of wheat and maize at their current levels of 12%, discussions of an increase to 15% and their eventual elimination are ongoing. These changes will clearly impact Argentina’s export prospects.”

- Biofuel policies in the United States, the European Union, and Indonesia, the three largest users of biodiesel, remain a major source of uncertainty in the vegetable oil sector given that about 16% of global vegetable oil supplies go to biodiesel production. In Indonesia, attaining the proposed 30% biodiesel mandate is doubtful given the need for government subsidies and possible medium-term supply constraints. In the United States Renewable Diesel or HVO receive considerable support in some states that show strong production growth rates. In particular, the California Low Carbon Fuel Standard favors expansion of renewable diesel over other types of biofuel. In the European Union, policy reforms, reduction of overall diesel use and the emergence of second-generation biofuel technologies will likely prompt a shift away from crop-based feedstocks, especially vegetable oils. Globally, Sustainable Aviation Fuels (SAF) are expected to be a substantial use of biofuels but the timing of introduction remains largely uncertain. The development of crude oil prices, which affects the competitiveness and profitability of biodiesel production, remains a major source of uncertainty.

On Oilseed:

- “In the United States, Hydrotreated Vegetable Oil (HVO) or Renewable Diesel is considered an advanced biofuel and is expected to drive the considerable growth of biodiesel production.“

- “ The crush location depends on transport costs, trade policies (e.g. different tariffs for oilseeds and products), acceptance of genetically modified crops, processing costs (e.g. labour and energy), and infrastructure (e.g. crushing facilities, ports and roads).”” The growth in China, although large, is projected to be considerably lower than in the previous decade. Global crush of other oilseeds is expected to grow in line with production over the Outlook period and to occur more often in the producing country.”

- In China and the European Union, most protein meal production comes from the crushing of imported oilseeds, primarily soybeans from Brazil and the United States. In the other important producing countries ‒ Argentina, Brazil, India, and the United States ‒ domestically-produced soybeans and other oilseeds dominate.

- “Growth will be dominated by yield increases, accounting for about 80% of production growth. Soybeans have the advantage of being fast growing which allows for double cropping, especially in Latin America. Consequently, a considerable share of additional harvested area increase will result from double-cropping soybeans with maize in Brazil and wheat in Argentina.“

- “In Canada and especially in Australia, more than half of the production of other oilseeds (primarily rapeseed) is exported. Additionally, oilseeds are crushed in the production countries and exported in the form of vegetable oil or protein meal, which is of high importance for Argentina, Ukraine and Russia.”

On Biofuels:

- “Conversely, the European Union’s contribution to global biofuel use is expected to decline. The inclusion of sustainability criteria in its revision of the Renewable Energy Directive (RED III) has led the bloc to shift away from first-generation biodiesel by setting a maximum limit for biofuels from food and feed crops.” : I thought it would continue to increase but slightly.

- “Emerging economies, notably Brazil, Indonesia, and India, are anticipated to drive most of the new biofuel demand “

- “[…] significant investments are still required to scale up production, manage the sustainable certification of feedstocks and enable marketing. Policies ensuring the supply of sustainable feedstocks are imperative, particularly as the focus on finding alternatives for the use of residues and byproducts of agriculture production grows to promote a circular economy approach in production of biofuels.”

- “Governments encourage the use of biofuels primarily to bolster energy security and to advance the reduction of GHG emissions. […] While the implication for energy prices of the Russia’s war against Ukraine has underscored the significance of the energy security rationale, its impact on the biofuels markets remains limited. The expansion of biofuels aligns with their critical role in the global strategy for decarbonising the transport sector.“

- Risk and uncertainty : “Fluctuations in fossil fuel prices directly impact the competitiveness of biofuels, often linked to subsidies for the sector. Volatility in oil markets tend to disrupt the biofuels market structure, potentially leaving long-lasting effects. Additionally, uncertainty surrounds feedstock supply, as countries typically prioritise surplus commodities for biofuel production to safeguard food availability and security. While blending mandates are anticipated to drive biofuel production in emerging economies, recent price surges in cereal and vegetable oil markets have reignited debates on the ethical implications of fuel versus food production. Exploring advanced biofuels presents opportunities beyond conventional crops, with cellulosic feedstocks like agricultural residues and energy crops offering potential for expanded production without compromising food supplies. “

- “While SAF consumption and production are not modeled explicitly in the Outlook, any significant increase in their use in the long term may have important impact on the use of advanced feedstocks, contingent upon technological advancements and ambitious policies. Biofuels may also play an important role in the decarbonisation of the maritime industry. Technological advancements and regulatory changes in the transportation sector could significantly impact biofuel market projections. Countries are expected to implement policies promoting new technologies to reduce GHG emissions, introducing uncertainty into agricultural markets and influencing future biofuel demand. The private sector’s response to these measures, particularly industries investing in EVs and SAFs, will shape biofuel usage trends over the coming decade and beyond.“