A (very short) history of biofuels

Biofuels have origins dating back to early societies, but their significant development began during the 20th century, particularly after the oil embargo. Since then, biofuels have emerged as a promising alternative to fossil fuels. From the 1980s to the early 2000s, many governments actively promoted the expansion of the biofuel industry, with various subsidies.

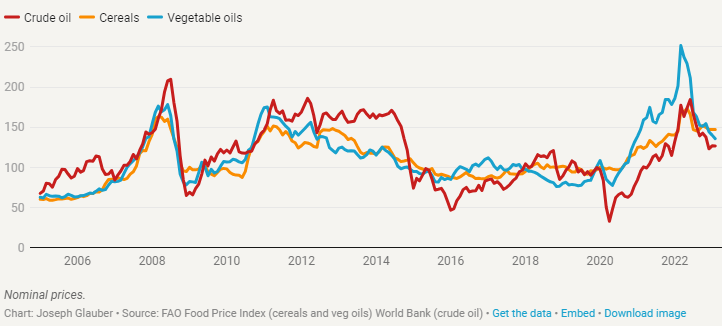

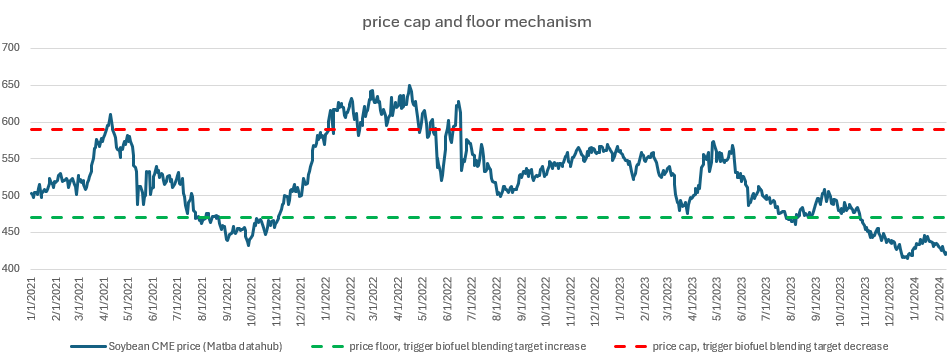

Derived from renewable biological resources such as crops, algae, or organic waste, biofuels seemed to offer the potential to reduce greenhouse gas emissions and mitigate reliance on finite fossil fuel reserves. But it was not that easy to do good deeds. The so-called “conventional”, or “first generation”, or “crop-based” biofuel made from food crops grown on arable land and their widespread adoption had sparked a contentious debate. This is the “food versus fuel” dilemma. When diverting agricultural resources away from food production towards fuel production, food prices will connect much more to oil prices, and jump, possibly very much as in 2007/08, 2010/11 and 2012/13. The Russia-Ukraine war has put the debate back on the table with grain prices high in 2022. The chart below, from a very interesting analysis gives a clear picture of this prices relationship, hard to model effectively, following wiki’s opinion:

“This complexity and uncertainty are due to the large number of impacts and feedback loops that can positively or negatively affect the price system. Moreover, the relative strengths of these positive and negative impacts vary in the short and long terms, and involve delayed effects.”.

Note that some “advanced” biofuels technologies have emerged since then as solution, see them in the annex below. They are in general more expensive, with uncertain potential in term of volume. But their development is supported by current regulations which tries to drive investment there, especially Europe and US. This will be discussed later in the article. Globally, the conventional generation biofuel will probably prevail for some time.

An overview of the physical market: some numbers

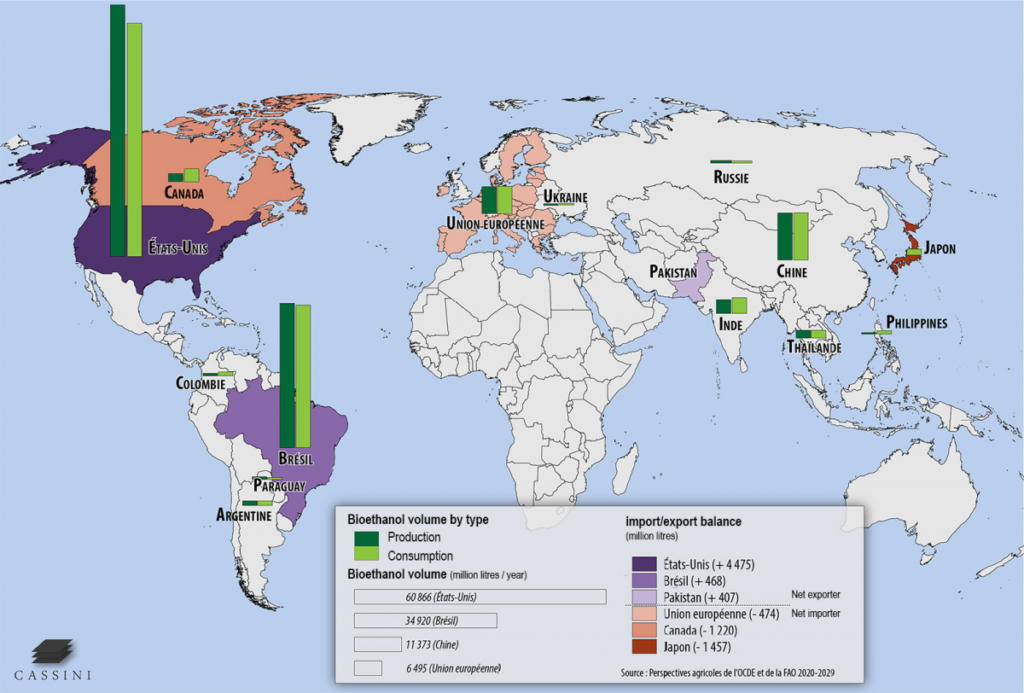

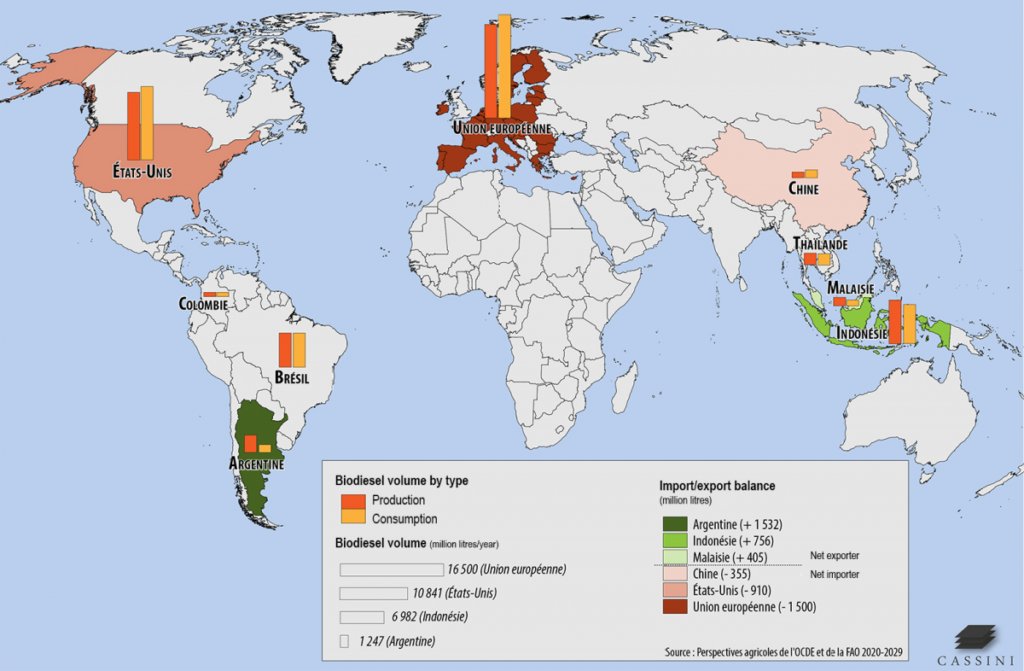

We focus on the conventional biofuels production/consumption and export/import by country. Production has increased tenfold in the last 25 years. Some details by countries can be found here:

A few comments:

- US and Brazil the biggest producers of bioethanol (derived from corn and sugarcane mainly) while US and Europe are main producers of biodiesel (derived from vegetable oil, US soybean, EU rapeseed)

- Note that 40% of all corn grown in the US is converted to ethanol.

- US the (very) big exporter of bioethanol, compared to Brasil, the second. Indonesia/Malaisia (from palm) and Argentina (from soy), the main exporters of biodiesel (curiously here, Brasil seems to be balanced).

- Curiously, there is no data for biodiesel in Canada. Probably missing data, they produced with both soy and canola (=rapeseed).

Now the iLUC risk

Following the “fuel versus food” dilemna, crop based biofuel has been questionned further : when measured correctly, they may not be so cheap in term of cost in GHG emissions. To measure their real cost, the following has been defined, for any crop:

“[The indirect Land Use Change (iLUC)] can occur when pasture or agricultural land previously destined for food and feed markets is diverted to biofuel production. In this case, food and feed demand still needs to be satisfied, which may lead to the extension of agriculture land into areas with high carbon stock such as forests, wetlands and peatlands. This implies land use change (by changing such areas into agricultural land) and may cause the release of greenhouse gas emissions (CO2 stored in trees and soil) that negates emission savings from the use of biofuels instead of fossil fuels.” (see this)

As one can imagine, iLUC measurement for a given crop is a very challenging task, with no consensus. The European Comission ” has determined that estimates of ILUC emissions from given crops are not robust enough to be used in regulatory lifecycle analysis” and the task was simplified in classifying crops in 2 categories, the “high ILUC-risk” and the “low ILUC-risk” (from this).

Some words on RED, the EU directive

Each part of the world has its own regulation, consequence of economical and agricultural context. Let’s dig into one, the European one, which put particular emphasis on the iLUC concept. The utilization of biofuels is driven by the Renewable Energy Directive (RED), which has been implemented in several stages. RED I was released in 2009, followed by a revision in 2018 known as RED II, and further updated in 2023 with RED III.

Under RED II/RED III, the use of crop-based biofuels has been restricted to 7% of the total energy consumption in Europe. Additionally, there has been a decision to phase out biofuels derived from palm oil due to their “high iLUC risk” . Currently (as of April 2024), discussions are ongoing to potentially remove soy oil as well for the same reason.

I don’t want to enter in a expert debate, on which I’ve only scratched the surface of. The determination between “high/low iLUC risk” is just too sophisticated. The certification guidance to dermine them accurately has been just released a few days ago and I am scared with the idea to read it carefully. But looking back at the production/consumption level above, this got me thinking, how relevant is it to define one crop or the other more or less “iLUC risky”. Production volume are so huge, in Europe, US and Brazil. Intuitively, they can’t be more or less responsible of the land use change, one more than the others. Some mandates by biofuel (biodiesel, bioethanol) can be more relevant than by crop, at a level above countries… Mmmmhhhh… How to define target then? Harsh debate, making all countries thinking together with a common objective, while taking into account accurately their local agricultural and economical context is definitively not an easy task, any stakeholder always defend his own meat.

Moreover, there is a push to promote the adoption of “advanced biofuels”, with a gradual increase targeted to reach at least 3.5% of EU energy consumption in transport by 2030. Interestingly, the list of authorized “advanced biofuels” includes intermediate/cover crops, which are crops grown between main crops.

Note that this is an EU directive, which has been implemented differently in country members (Germany with a lower cap on food crops, France having already banned palm and soy oil).

A very brief overview of worldwide biofuel policies and mandate

Overall, more than 80 countries have policies that support biofuel demand. Each part of the world has its own regulation, consequence of economical and agricultural context. Some good ideas of numbers are found here. Argentina having increased its biodiesel blending target in 2022, in a near term, Indonesia probably expanding its biodiesel blending target to 35% from 30% and Brazil to 15% from 12% in 2023. The US equivalent of European RED directive is the RFS: Renewable Fuel Standard. similarly to Europe policy, it tends to incentive advances biofuel use, limitating the use of conventional biofuel.

In general, biofuel policies and mandates, which are constantly evolving, have created challenging pathways for the industry. “… political uncertainty, short-term policy measures, and frequent changes to policy measures contribute to making investments in industry, and, thus the development of renewable fuels, more difficult.” here for more details.

At the 2030 horizon, the global objective seems to develop significantly advanced biofuel. It tries to limitate conventional biofuel, but it will continue to progress, at least at 2030 time horizon. This is very clear in this chart. This iLUC risk seem “already taken” somehow.

Also, constantly evolving policies and mandate put in question the feasibility of reaching the desired objective.

Analysis and market mechanism proposal

Okay, le’t summarize a bit what said:

- Since the 80s, biofuels production have evolved significantly as a solution to reduce GHG emission.

- Crop-based biofuel production has generated an important “fuel versus food” debate not yet resolved, with food prices jumping connected to oil price volatility.

- On top of this debate, these crop-based biofuels emit more GHG emissions than initially thought, when considering the iLUC: indirect Land Use Change.

- Accurate iLUC measurement is tough, even if its existence is not questionable. All (main) crop-based biofuels exhibit probably significant iLUC risks.

- Advanced (sustainable) biofuels are supposed to solve these issues. They will continue to gain traction. But crop-based will probably continue to prevail for some time.

- Constantly evolving policies and mandates put in question the feasibility of reaching out such objectives.

Well, the journey of decarbonization is a hard way to go in biofuel industry, halfway between key commodity markets, it is the angel and demon of GHG emission contribution. This topic is stimulating. How to imagine some improvement on a market modeling point of view? Enhancing measurement of iLUC will be vain, probably. On the price relationship, we can imagine something, maybe.

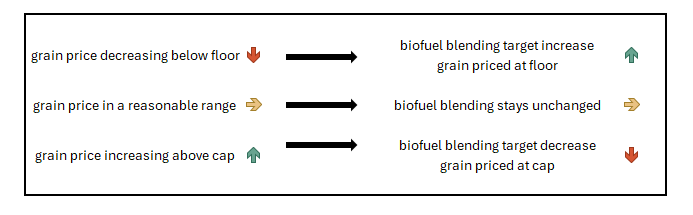

Today, grain prices are rather low, due to high level of stocks. This is challenging for farmers who will soon decide their crops planting plan for next season. If they reduced significantly their planting, we may have some volatility in the next months. It can help to adapting biofuel blending target, according to grain market level. It would consist in increasing the biofuel blending target to support the demand, consume stocks at a floor price, thus keeping prices to reasonable level for farmer margin. When prices are high, biofuel blending target would be decreased, with a price cap set, reducing the demand.

Note that we may question the best mechanism. Here, they are some sort of put and call options, with volumes to be set accurately. Note that this develop a similar idea, talking about “off-ramps for biofuel mandates”, without price trigger. I suppose that’s better to fix prices when adapting biofuel grain demand in order to enhance the price volatility reduction. But the debate on the best design is left open and need to be studied deeply. The idea is anyway to reduce grain market volatility, which is good for all actors, with biofuel consumption acting as a sort of buffer, a “regulatory” hedge.

Note than in the US, the grain markets are supported by a market assistance loan program from the USDA, providing some sort of price floor for US farmers. They probably do not propose market assistance inter-markets.

This is of course just an idea thrown out there, its design and implementation would be a very long journey, with a collaboration between countries very welcome. This would reduce market volatility on short term basis without altering biofuel target purpose on a long term basis.

Conclusion

Today, the biofuel market continues to be highly politically driven, contributing to understandable uncertainty. While ongoing awareness of iLUC (indirect land use change) risk is beneficial, its measurement adds to this uncertainty. The relationship between food-to-energy prices will persist, as crop-based biofuels will continue to be necessary in the journey towards decarbonization, as indicated by the forecast for 2030.

Establishing biofuel blending targets based on grain market dynamics can help mitigate grain volatility, benefiting all stakeholders. This wouldn’t alter the long-term purpose of biofuel targets. Ideally, such initiatives should be collaborative efforts between countries to ensure consistent biofuel mandates and effective consequences. Designing and implementing such measures pose significant challenges, this goes without saying.

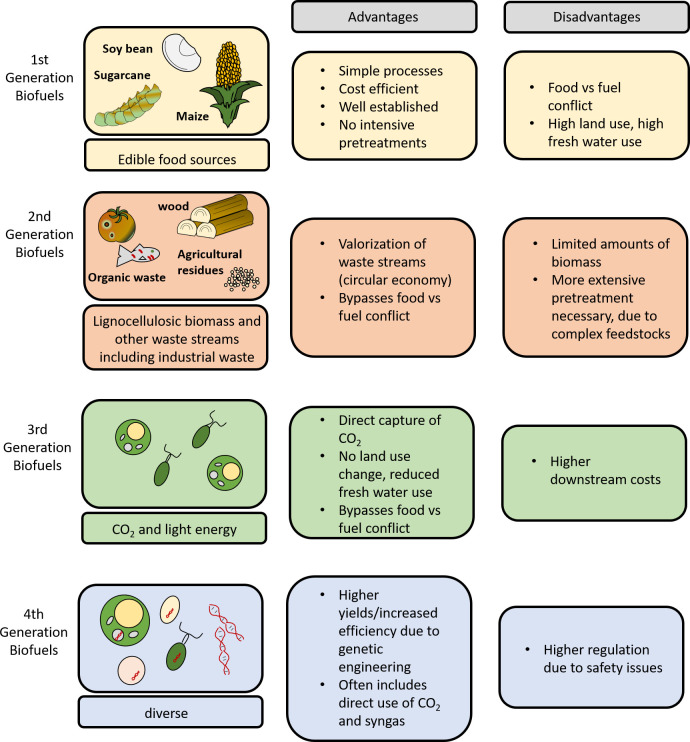

Annex: the different biofuel categories

A few others categories of biofuel have emerged, the “advanced biofuels” (2nd, 3rd and 4th generation), not having the disadvantages of the “food versus fuel” debate as the first generation detailed above. Here a precised descriptions of the 4 categories, their chart says it all.

The “advanced biofuels” have been significantly developped in the last years, they are very promising technologies but have limited volume and higher cost compared to the first generation/crop based biofuel.

(image above taken from https://gofbonline.com/europes-renewable-energy-directive-to-be-next-episode-in-the-trade-and-climate-change-debate/ and https://www.hemmings.com/stories/2013/07/10/a-brief-history-of-biofuels-from-the-civil-war-to-today)